The 2025 Go-Tober Challenge is a wrap!

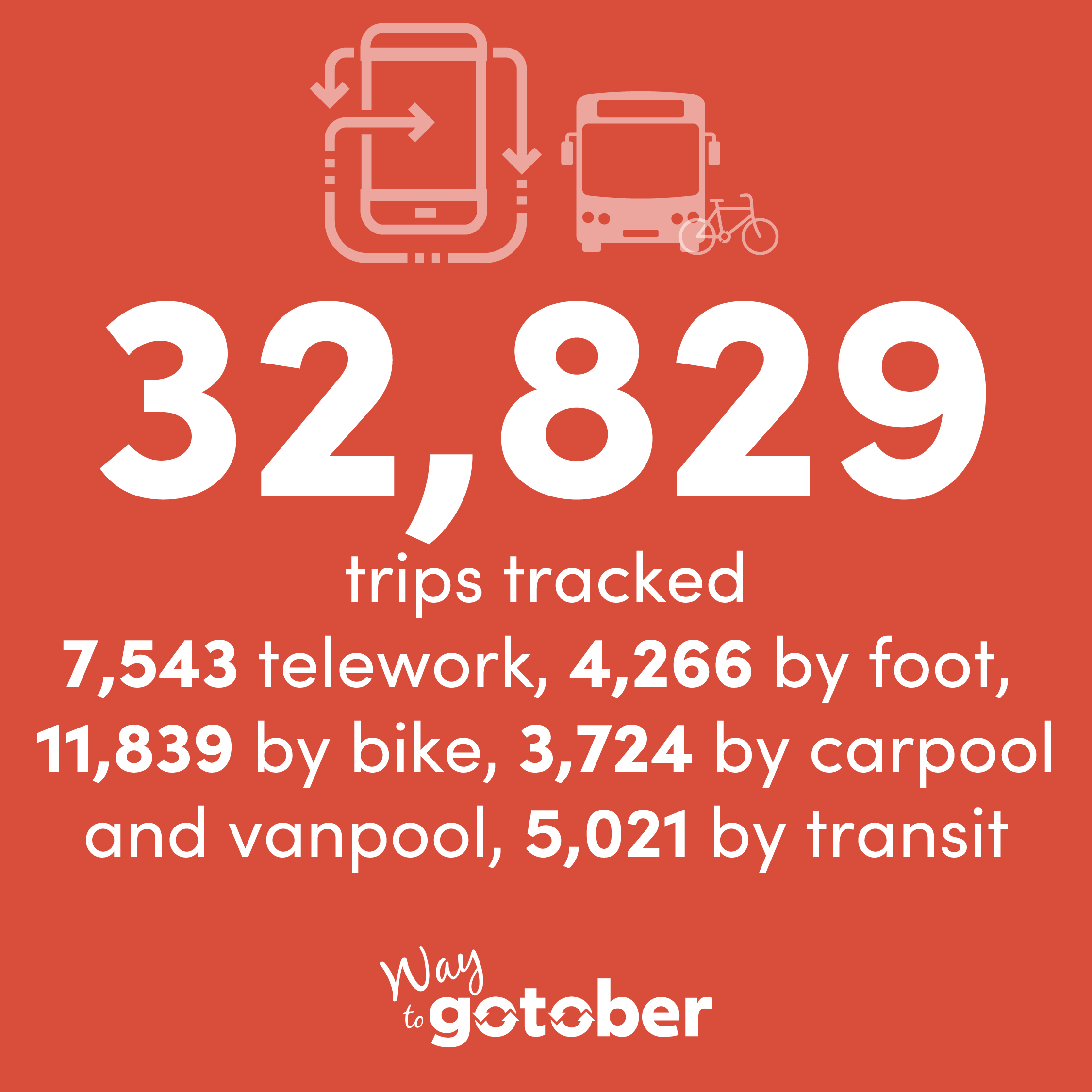

Each October, employers throughout the Denver region join the Go-Tober Challenge to improve air quality, encouraging commuters to skip their solo drives and choose sustainable transportation like transit, biking, walking and carpooling. During Go-Tober, participants reduced a total of 112 tons of carbon dioxide emissions and saved themselves almost $200,000 in commuting costs!

Congratulations to the 1,323 people and 87 organizations that participated in the 2025 Go-Tober Challenge! These five companies topped the leaderboard in their size categories:

- XL (2,001 employees or more): Colorado Department of Transportation

- L (501 - 2,000 employees): Town of Castle Rock

- M (101 - 500 employees): Muller Engineering

- S (51 - 100 employees): Consor Engineers

- XS (1 - 50 employees): Regional Air Quality Council

Your organization can foster a work culture that provides employees with flexible commuting options. Call Way to Go 303-458-7665 or email the Way to Go team to set up a free consultation.